Causes of Inflation in Zimbabwe

A report from the World Food Programme indicates that as of 2019 an estimated 23 million people suffered from poverty as a result of the countrys worst hunger. The Federal Reserves attempts to fight stagflation only worsened it.

Zimbabwe Inflation Data Chart Theglobaleconomy Com

If we look at inflation and interest rates in the post-war period we can see interest rates rose to 15 in 1990 to deal with inflation of 10.

. The government printed money to pay for the war in the Congo. When we think of inflation we usually think of how it affects us as consumers. That sent inflation up to 133 by 1979.

With inflation quadrupling since February many Zimbabweans are struggling to cope. The inflation rate was 98 a day and prices doubled every 24 hours. Zimbabwe has a long history of droughts which have cumulatively caused an increase in poverty.

Here are some ways in which inflation affects businesses. My results are inconclusive. I heard something that sounded like a voice.

When the government decides to print money or implement a quantitative easing program the money supply is increased ie. It has been attributed to various causes including pandemic-related fiscal and monetary stimulus supply shortages including chip shortages and energy shortages and the Russian invasion of Ukraine. La monnaie étant létalon des valeurs la variation de sa.

The argument is that if people. But the effects of inflation are wide ranging including not only individuals but also businesses and even countries. They kept prices high even when the Fed lowered rates.

Inflation may seem like a straightforward concept but it is more complex than it appears. Zimbabwes annual inflation has risen to more than 250 - its highest level for a year and a half. The book of Revelation foretold rising food prices during this period of time.

Inflation and interest rates post-war. Well yes and no. In the troubled Yugoslavia of the 1990s inflation hit 50 a year.

Inflation may not have moved but that was only because the cost of QE was shifted through long-term interest rates to pension funds social welfare and insurance companies actuarial valuations will support that. Between 1971 and 1978 it raised the fed funds rate to fight inflation then lowered it to fight the recession. As part of monetary policy many countries have an inflation target eg.

Consumers and businesses alike have to deal with the impact of inflation both good and bad. It said A quart of wheat or three quarts of barley will cost a full days pay. Seigniorage derived from specie metal coins is a tax added to the total cost of a coin metal content and.

Zimbabwes annual inflation has risen to more than 250 - its highest level for a year and a half. More recently in Zimbabwe prices doubled every day. 2020s massive money supply surge exceeds the ability of the aforementioned institutions to absorb it by a long shot which will almost.

With inflation quadrupling since February many Zimbabweans are struggling to cope. Also droughts and farm confiscation restricted the supply of food and other locally produced goods. Soaring inflation causes fear.

Many countries have seen their highest inflation in decades and their central banks have responded by increasing interest. Monetary inflation thus affecting the general level of prices. There are many different causes of inflation but the most important cause is an increase in a countrys money supply.

People worry about their future and whether they will be able to provide for their family. On a regional scale droughts often result in crop failure loss of livestock and wildlife and power outages. Seigniorage ˈ s eɪ n j ər ɪ dʒ also spelled seignorage or seigneurage from the Old French seigneuriage right of the lord seigneur to mint money is the difference between the value of money and the cost to produce and distribute itThe term can be applied in two ways.

Learn here about its varieties and causes. Second there are no predictable causes of visible inflation in a global market. This stop-go monetary policy confused businesses.

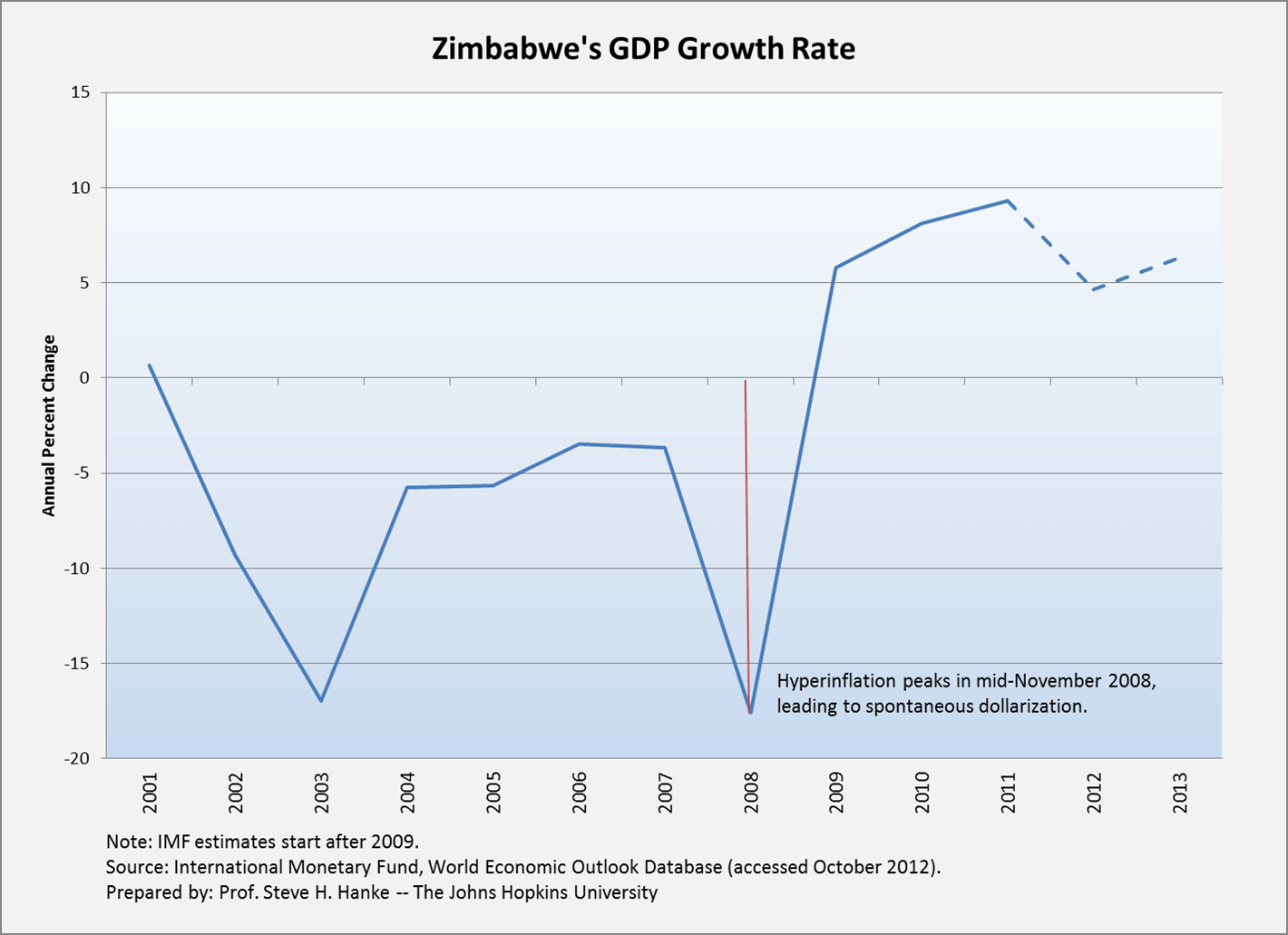

In early 2021 a worldwide increase in inflation began. Zimbabwe experienced hyperinflation between 2004 and 2009. Venezuelas consumer prices grew by.

UK inflation target of 2 -1. As we can see in the following chart the Federal Reserve. Linflation est la perte du pouvoir dachat de la monnaie qui se traduit par une augmentation générale et durable des prix accompagnée par une baisse des taux 1Il sagit dun phénomène persistant qui fait entre autres monter lensemble des prix 2 et auquel se superposent des variations sectorielles des prix 3.

As a result hyperinflation was worse than in Germany. Yet the puzzling nature of their indications is evidence against broad monetary claims.

Zimbabwe S Four Year Anniversary From Hyperinflation To Growth Cato At Liberty Blog

Zimbabweans Stock Up On Essentials Amid Fears Of Hyperinflation Africa Dw 28 09 2017

What Happened To Zimbabwe When They Were Experiencing Hyperinflation Quora

What Happened To Zimbabwe When They Were Experiencing Hyperinflation Quora

Comments

Post a Comment